One of the first things you do when you get a new job is set up your 401k (if you’re fortunate enough to work for a company that offers one). For a lot of people this means putting 5% in to reach the company match (aka free money), and then they forget about it for the next 30+ years (not the best strategy in my opinion!).

First .. is 5% enough? Probably not. Some people will be more aggressive and start with a 10% contribution. Is 10% enough? How do you determine what is enough? When and how can you increase your 401k contribution amount?

Is there a way to increase your contribution and increase your paycheck? The answer is, YES.

|

| Is your 401k leading you down the right path? |

It’s important to keep in mind companies are moving more and more away from pension plans and towards 401k plans. This is or might be your main source of income in retirement. Don’t be a person who plans to live off of Social Security (SS) in retirement. Rather think of SS as a bonus if it is there when you retire.

For this post we are going to make the following assumptions:

Person A: Starts their career in 2020 with a salary of $60,000.

Person A: Consistently receives annual salary adjustments that average 2.5% per year.

Person A: Works for a company that offers a 5% company match (free money).

Person A: Has access to / invests in a S&P 500 index fund in their 401k plan. (As they get closer to retirement, they may allocate 10 - 20% of this to a total bond market fund. For this post, let’s keep it simple and assume they stay 100% invested in the S&P 500 Fund).

Rate of Return = ROR; Return on Investment = ROI

Example 1:

Person A needs to decide the amount they want to contribute. We know they are offered a 5% match from the company, so to do anything less than this is literally like throwing money away. In Example 1, we will assume they are going to contribute 5%, and then they forget about it. Over the years they consider logging in and adjusting their contribution amount, but they hate the idea of making their paychecks smaller ... and they just never really get around to it. Let’s see how much they are left with in this 30 year estimate. Note: Salary increased based 2.5% each year, and the example is based on salary starting at $60,000.

|

We see that by contributing 5% with a 5% company match this scenario provides around $855,000 in 30 years. That amount doesn’t look too bad in the year 2020, but in the year 2050 this would only provide about $350k worth of spending power after accounting for 30 years of inflation (based on this calculator using 3% inflation).

I don’t know about you, but I’d like to have more than that waiting for me after putting in 30 long years of work.

Example 2:

In this example, Person A decides to be more aggressive with their initial contribution (good for them!), and they start with 10%. But just like in the first example, the years go by, life gets in the way... They get married, have kids, buy a house, etc. Even if they wanted to increase their contribution at this point, they simple can’t imagine decreasing their pay check to do it. They make the decision to hold steady at 10% for the 30 year period. Let’s see how they do after 30 years. Note: Salary increased based 2.5% each year, and the example is based on salary starting at $60,000.

|

That extra 5% per year contribution really paid off. As you can see above, instead of having $855,000 after 30 years, they are left with around $1,283,000. This certainly is a better situation to be in financially, but let’s consult our chart to see how much spending power this will give us 30 years down the road.

|

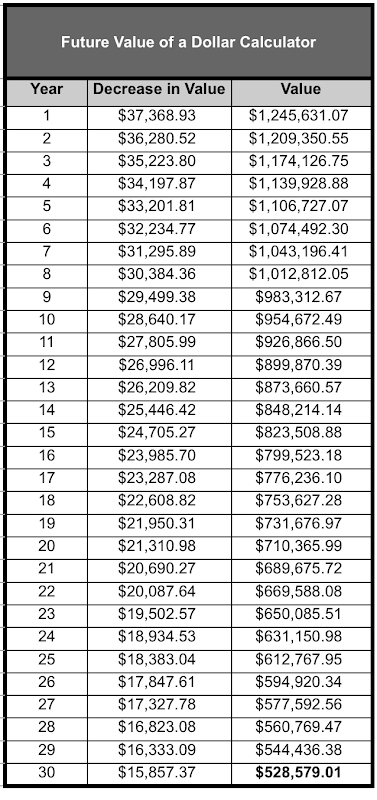

This time Person A has a spending power of around $529,000 during retirement. This is certainly better than in the first scenario, but this is still not nearly as good as one would think.

This brings us to the personal strategy that I used during my career. With this strategy, a person can increase their 401k contribution while still increasing their pay check. Here’s how to apply it:

Example 3:

Typically every year your employer is going to provide you with salary adjustments. Let’s assume they fall between 2 - 3% per year. For this example, we are using the middle ground and assuming an average of 2.5% salary adjustment per year. Let’s also assume this adjustment takes place in March each year. This means by late February, your supervisor has already gone over your salary adjustment, and you know the exact amount. Assuming a 2.5% salary adjustment, you would allocate 50% of this to your 401k contribution (or 1.25%).

Timing Is Everything

The trick is to do this BEFORE the salary adjustment happens. In this example, it changes in March, so in late February (preferably after finding out your exact adjustment for the year) you would need to log into your 401k and increase your contribution by 1.25% (or whatever 50% of your salary adjustment equals). The timing is important because it usually takes a pay cycle for the change in your 401k to go into effect. In this example you are still left with a salary increase of 1.25% on your next paycheck. Congratulations! You have just managed to increase your 401k contribution while also experiencing a bigger paycheck from your salary adjustment.

Let’s look at the 30 year numbers when using this strategy. For this chart, Person A is going to start off similar to the last example with a 10% contribution, and then they are going to increase it by 1.25% per year (50% of their 2.5% salary adjustment). Using this strategy, Person A is able to start maxing out their 401k at the current allowable max of $19,500 by year 2032, and Person A continues to max it out through 2050. Note: Salary increased based 2.5% each year, and the example is based on salary starting at $60,000.

|

| Add caption |

Person A is left with around $1,967,000 after 30 years, and the spending value in today’s dollars of $810,000. Now things are looking much better!

|

The Takeaway

If you have a 401k and you are contributing 5% or less, it almost certainly isn’t going to be enough in retirement.

If you are contributing 10% for 30 years this definitely helps; if you also have a Roth IRA and Social Security, this could provide a decent retirement. But who wants to settle for decent??

Using the strategy presented in the last example, you are able to slowly increase your 401k contribution amount every year while also experiencing a bigger pay check from your annual salary adjustment. You timed the changes in your 401k contribution amount a couple of weeks before the salary adjustment goes into effect. In other words, your 401k gets a raise AND your bank account gets a raise!

So what do you think? Do you contribute to a 401k? Do you increase your contribution (and paycheck) yearly until you max it out? Like what you read? Comment below, and share our post!

Contact us (Erik) to see how we can help you with your 401k or other numbers: Financial Consulting.

Read Tara’s latest post here ... City School: Raising Kids To Be FI (Financially Independent).

-Erik

No comments