Teacher's salaries have been a hot topic lately (as they should be). TIME Magazine made the subject of teacher's salaries a cover story in September 2018: 13 Stories of Life on a Teacher's Salary.

I definitely know how challenging it is to be a teacher (no one can understand unless they are in the trenches as a teacher) and how (in most cases) teachers aren't adequately compensated. And related to that ... yes, the profession in general (at least in our country) seems to not be appropriately respected by the general public. But this blog post isn't about that. This post is about how at least one family of four (our family) can live on a teacher's salary (and save the higher salary). We definitely understand that every situation is unique.

-Tara

I definitely know how challenging it is to be a teacher (no one can understand unless they are in the trenches as a teacher) and how (in most cases) teachers aren't adequately compensated. And related to that ... yes, the profession in general (at least in our country) seems to not be appropriately respected by the general public. But this blog post isn't about that. This post is about how at least one family of four (our family) can live on a teacher's salary (and save the higher salary). We definitely understand that every situation is unique.

-Tara

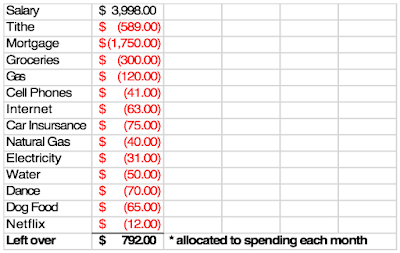

We want to break down more specifically just how a family of four is able to live comfortably off of just one salary (a teacher's salary at that). We are able to allocate the second (higher) salary to savings / investments for our journey to financial independence (FI).

We touched on this in previous posts, but now we want to take you line by line to see just how we do it.

We would not be able to do this if we were still carrying around debt from cars, school loans, credit cards, etc. It wasn’t until 2015, (the year that we paid off all of our debt) that we were able to start living off of just one salary.

We will break this down exactly as it appears in our budget, which is just a very basic excel spreadsheet that I have been using for the last 10 years.

Total Teacher Salary (After tax) Per Month = $3,998

|

| Our youngest working in my (Tara's) art classroom. |

|

| Tara with both kids on the first day of school (in my (Tara's) art classroom). |

Item 1: Tithe = ($589)

This is the amount that we give to our church on the 1st of every month. We started consistently doing this 7 years ago by giving 1% per month and have upped it by an additional 1% per year with the goal of eventually reaching 10%. I tried just giving 10% outright in the past, and I never stuck with it. Building the percentage up slowly has helped us with consistency. (Others who don’t tithe could use this part of their budget for donations, etc.)

Item 2: Mortgage = ($1,750)

This includes principal, interest, windstorm, and property taxes. We could actually pay this off at any time with the money in our Vanguard account. But since the interest rate is so low and we only plan to live in our current house for another couple of years, it makes more sense to put the money into the stock market with VTSAX.

Item 3: Groceries = ($300)

We have been able to maintain this level of spending for groceries by eating a plant based diet revolving around whole grains, fruit, vegetables, potatoes, and nuts for the most part (no, not just bread and water on $300 / mo). That said, with a little bit of planning, I am confident I could make this same budget work while also buying meat and eggs.

|

| Our homemade food on a $300 / mo budget. |

Here are some tips to help get your grocery spending down (what tips do you have?).

Drink water! Don’t buy juice or soda. It’s not good for you, and the cost adds up. I confess I will break down and buy the kids orange juice, but only when I am able to buy all of our other staples first (and if we have money leftover within our $300 budget). After all, if you want orange juice, eat an orange!

Don't drink milk / drink less milk. Only use milk for cereal, coffee (if that’s how you like it), or baking. All your body needs is water so you can stop drinking it. Spinach helps with calcium, and the sun is great for Vitamin D.

We actually make our own vanilla rice milk at home which saves at least $20 per month.

Baking Soda and Vinegar: Use as your primary cleaning products. Both are cheap, and do a great job. (Baking soda also has many other great uses!)

Make a List: Don’t go to the grocery store without a list. This is just asking for trouble. We like to plan our meals for the week ahead of time so that we know exactly what we need once we are in the store. I also remember the prices of products like a Price is Right winner, but for most people just having a list written out (and sticking to it) will help you save.

Item 4: Gas = ($120)

We became a one car family by choice back around 2013, and this helped cut down on our gas bill (we were recently gifted a second car (see below), but we still only use one car 95% of the time). While this may not seem like a realistic option for most right off the bat, think about it before you completely write it off. If you are a couple that both work is it possible to carpool to and from? Could you ride your bike (I do) or walk/jog to work? What about taking public transportation in your area? If you really stop to think about it, you could probably eliminate one of the cars if you really had to. It doesn’t hurt to try it out for a month. If it works then great - get rid of the extra car. If not, then at least you tried!

Item 5: Cell Phone = ($41)

Say it with me, Republic Wireless, Republic Wireless, Republic Wireless. We switched back in 2013 and haven’t looked back.

Item 6: Internet = ($63)

This is one area that I would actually like to get the price cheaper than this, but it’s hard to do when you aren’t bundling cable, phone, etc. (and you shouldn’t because you canceled cable and use Republic Wireless for your phone, right?).

Item 7: Car Insurance = ($75)

Alright confession time. A couple of months ago we were gifted a car by our much too generous parents (who says no to a free car?) and so this cost went up from $45 per month to the current $75. I still consider us to be a one car family for the most part because our old car just sits in the driveway 95% of the time. In fact, we have had two cars for over three months now, and I still haven’t used a tank of gas in the old car yet. All that said, if you haven’t tried GEICO for your car insurance needs, now is the time. They will almost certainly beat the rate you are currently paying.

Item 8: Natural Gas = ($40)

This expense is pretty self explanatory, and we actually over budget a little bit for it because it does tend to go up during the “winter” months (Houston "winter" months). If you live in a really cold climate where this bill gets in the hundreds, then drop the temp! We keep ours at 60 when we aren’t home and no more than 64 when we are home. This keeps our bill manageable during what few cold spells we experience living in Houston.

Item 9: Electric = ($31)

This is not a typo. Our electric bill has been $31 since we switched to our new plan back in April. To sum it up, if we stay under 1000 Kwh for the month, we have a fixed bill of $31. When I originally signed us up for this plan I anticipated having a couple of the summer months go over 1000 Kwh. They probably would have had it not been for two long summer trips (one week each) that we took in June and July. We are also pretty conservative with the thermostat (which is where the majority of the electricity is being used). We keep our AC at 80 when we are home and just hanging out and usually drop it to 78 (me) or 76 (the wife) when we go to sleep. When we aren’t home that bad boy gets pushed up to 84. If 84 seems too extreme for you then take baby steps. Try bumping it up to 80 or 81 when you leave, and work your way up. There really is no point to have it below 80 when nobody is home, that’s just throwing money away. One final note, we live in Texas where we have the power to choose our electric provider. If you are lucky enough to live in a state that allows you to choose, by all means shop around for the best deal!

Water / Sewer = ($50)

Not much to say here. Some months we are able to stay under budget on this, and some months we are a little over. We don’t stress about this one all that much; it is what it is.

Dance = ($70)

This is our daughter's ballet and tap class. Unlike sports which have seasons that end (logical right?), this little rascal is basically year round so it gets lumped with our monthly budget rather than just our variable spending (and I digress). (Although she doesn't go during the month of July).

Dog Food = ($65)

You have to feed the beast! We have stuck with the same dog food that the breeder recommended. This cost is for a 25 lb bag, and it gets delivered (PetFlow) right to the front door every month.

Netflix = ($12)

Ahh Netflix. This $12 is worth its weight in gold because it will allow you to cancel your $100 cable bill (do it now!). Also, check your local library for free DVD’s (movies and TV shows). We have been using a combination of the two for the last 5 years and haven’t missed cable at all (we also use a Mohu Leaf to pick up all of the local channels for free). We have Amazon Prime too, but that isn't counted in our monthly spending.

Let’s Do The Math

|

| Our youngest working in my (Tara's) art classroom. |

What do you think? How do you stretch out or make your salary work?

-Erik